Recent economic news, coupled with the recent buoyancy in crude oil prices, has started to inject a degree of optimism about the opportunities for a rebound in offshore Gulf of Mexico crude oil and natural gas activity.

Unfortunately, it is unlikely that GOM offshore oil and gas activity will return to levels experienced in the past due to a number of structural changes that are intertied with the emergence of unconventional oil and natural gas development.

While it is true that unconventional wells can be drilled quicker, often easier, and less expensively than their offshore counterparts, this only explains a part of the structural change in the offshore GOM. A close review of historic drilling rig activity and production numbers helps to explain a larger part of this structural shift.

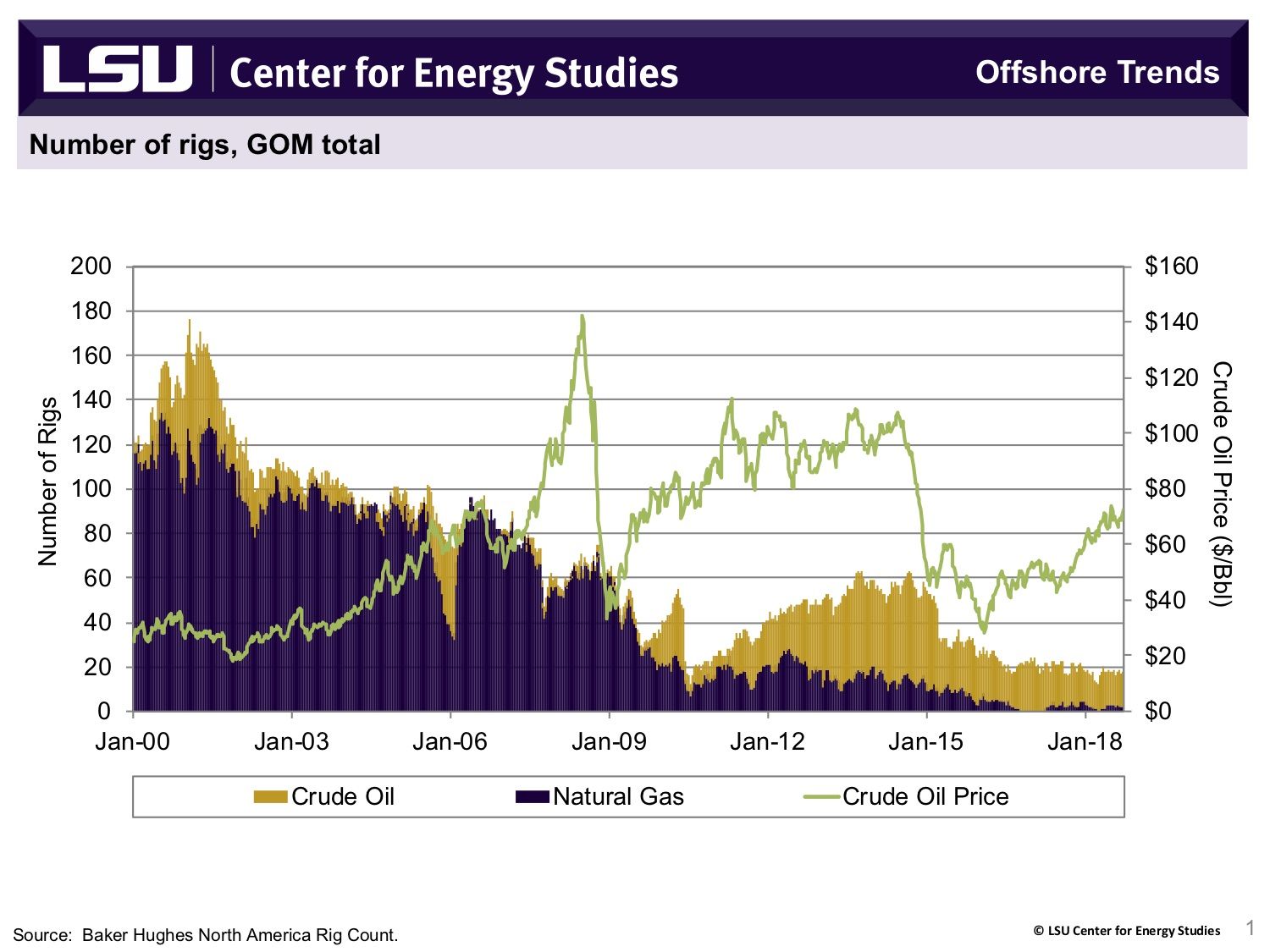

Offshore drilling activity over the past two decades has not been evenly distributed between crude oil and natural gas activities. In fact, as Figure 1 clearly shows, most of the offshore activity over the past twenty years (80% to 90%) has focused on natural gas development.

During this time period, the GOM was one of the most expansive and concentrated regions for U.S. natural gas production, accounting for as much as 25% of all U.S. natural gas supplies prior to Hurricane Katrina.

During this time, the concentration of natural gas production came with a cost: a very high number of active rigs given the increasingly lower marginal productivity of the resources being developed. Active rigs in the GOM were in excess of 80 for the better part of the decade and did not fall below 60 until the 2008-2009 economic recession, when natural gas demand started to flatline and natural gas prices started to fall.

Drilling trends, however, have changed dramatically since the 2008-2009 economic recession, when crude oil prices began their upward ascent to $100 per barrel (Bbl). Post-recession crude oil prices flipped offshore drilling emphasis away from natural gas and towards crude oil development.

Rig activity became more subdued after the recession, reaching a high point of 60 active offshore rigs before the 2014 crude oil price crash.

Since that time, the offshore rig count, which continues to be dominated by crude-oil based rigs, has remained around 20 despite a surge in prices from their 2016 low of about $28/Bbl.

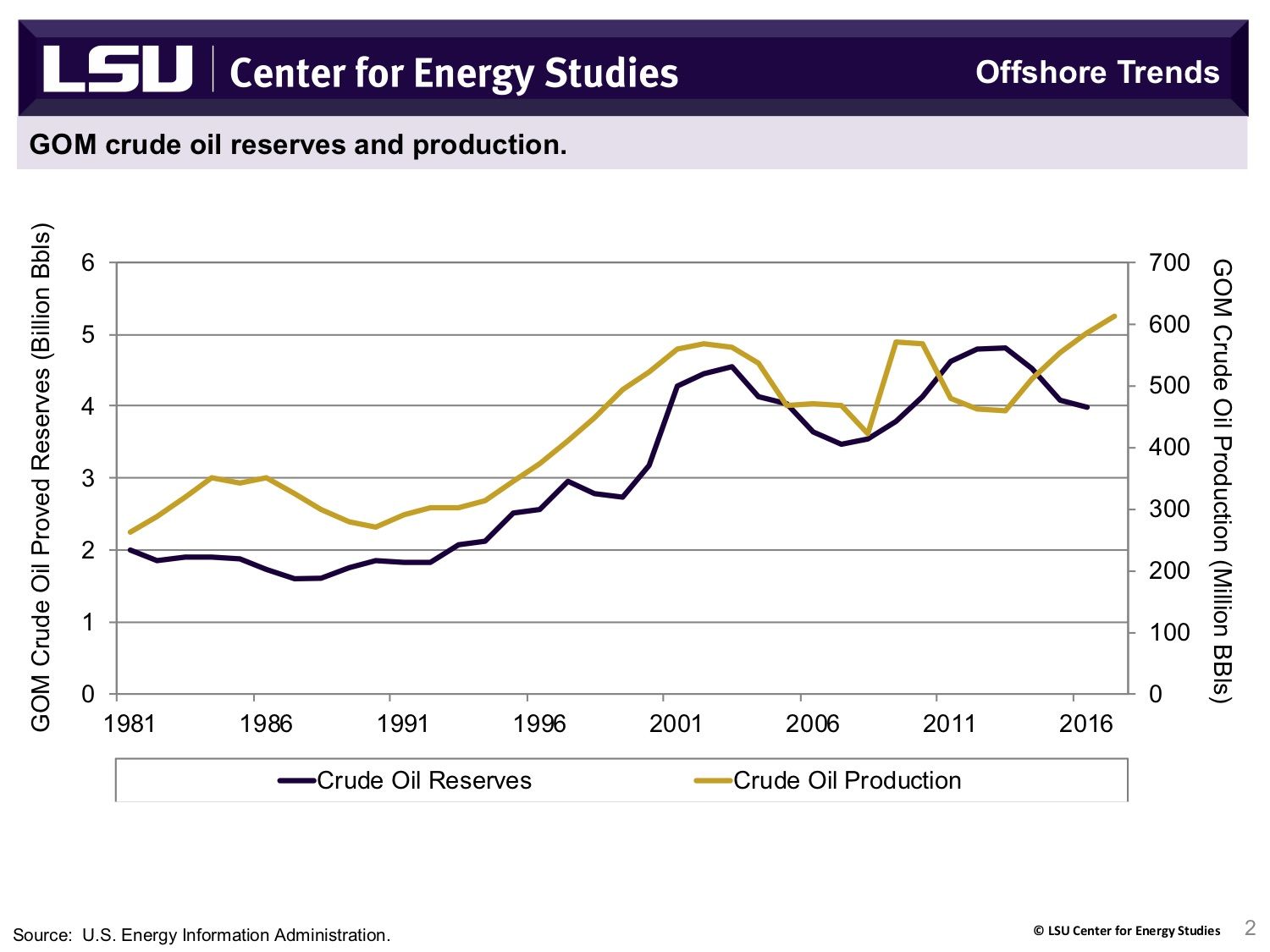

On a positive note, the post-recession emphasis on crude oil drilling has led to a reversal of the two decades old productivity declines seen in the offshore GOM. Most of the crude oil rigs put into action after the last recession have led to a prolific increase in offshore crude oil production and reserves. Figure 2, for instance, shows that annual GOM offshore production is currently at a 35-year high of some 600 million Bbls and reserves are only slightly down from their prior 35 year high of 4.8 billion Bbls.

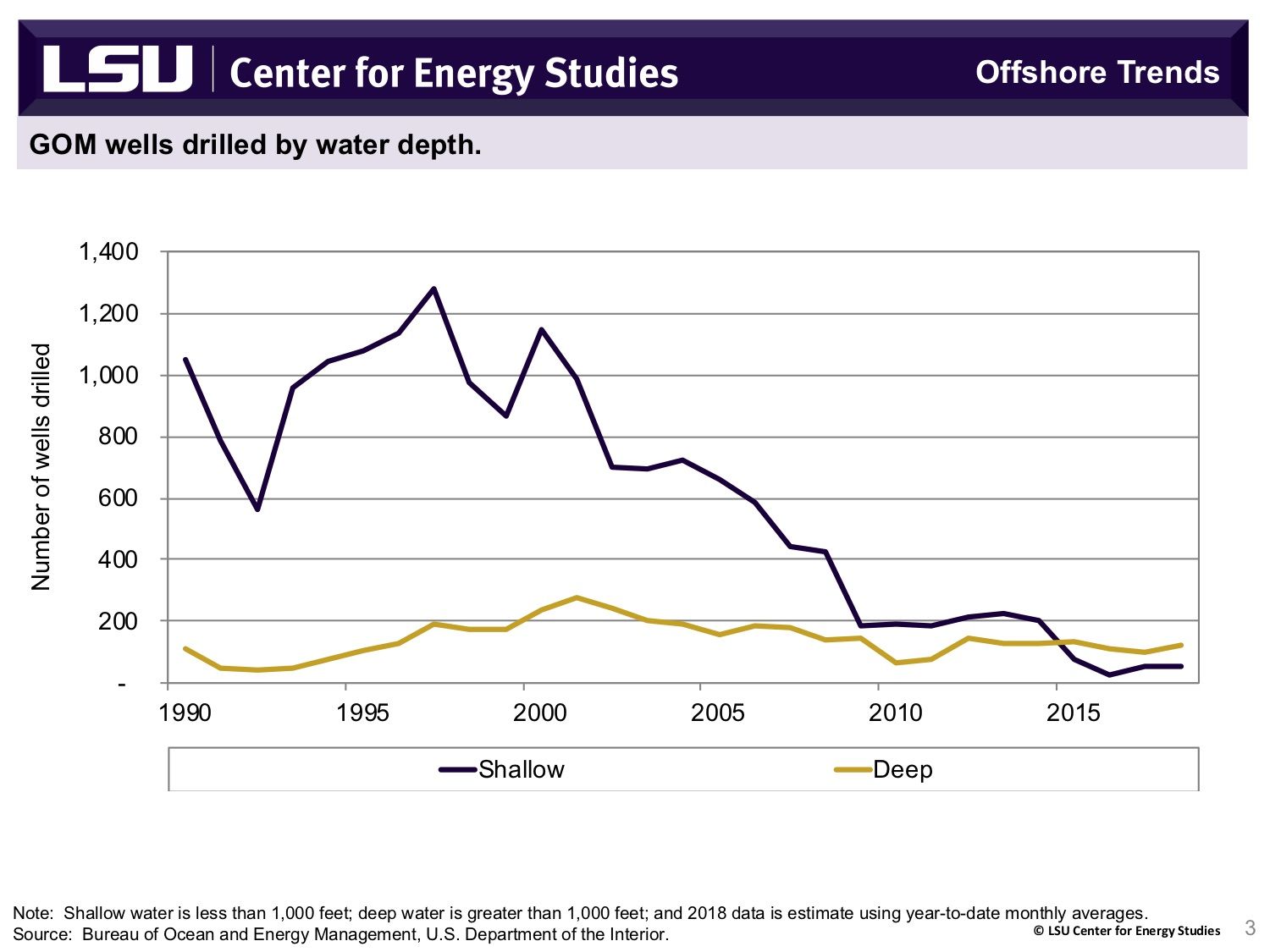

The last piece of the puzzle in understanding the structural change in offshore activity rests with recognizing “where” this activity is occurring within the offshore GOM.

Figure 3 highlights the number of wells drilled in the offshore GOM based on water depth. The chart shows that while shallow water activity (that occurring in less than 1,000 feet of water) has been failing considerably over the past decade, deep water activity has been relatively constant and almost insensitive to prices.

Thus, the declining fortunes for the GOM can almost entirely be attributable to the composition change in offshore drilling away from “higher frequency” natural gas drilling in shallow water, and to longer-horizon, more capital-intensive crude oil drilling in deep water.

Hence, it is unlikely that the current increases in crude oil price will lead to a level of offshore activity reminiscent of the prior two decades. Natural gas development in shallow water appears to have been completely ceded to onshore unconventional activity.

The offshore GOM activity that remains will likely focus exclusively on fewer, longer-term yet larger producing crude oil wells in deep water.

In fact, using drilling rigs as a “barometer” for offshore activity has probably passed its usefulness. Figure 2 clearly shows that a handful of highly-sophisticated drilling ships and floaters can lead to a prolific amount of crude oil production. This enhances the productivity of all resources used for offshore development—not just capital, but labor as well.

The good news is that the employment opportunities associated with this continuous and steady crude oil-oriented deepwater activity will lead to jobs that, while more limited in total number than what has been seen in the past, are highly specialized and high paying.

This also means that the GOM will continue to be an important crude oil producing basin that can hold its own with many individual unconventional plays like the Bakken, Eagle Ford, and even the Permian. The bad news, however, is that the offshore GOM has traded “high-churn” activity with “high-value” activity, and that trend will likely not change anytime soon.

David Dismukes is a professor and the executive director of the Center for Energy Studies at Louisiana State University. He holds a joint academic appointment in the department of environmental sciences, where he regularly teaches a course on energy and the environment.

![Why Louisiana energy expansion should matter to you [Opinion]](https://www.1012industryreport.com/wp-content/uploads/2021/04/Energy-Evolution-218x150.jpg.optimal.jpg)

![Melancon: Pipeline disputes could pose risks to Louisiana’s energy sector [Opinion]](https://www.1012industryreport.com/wp-content/uploads/2016/11/Pipeline-218x150.jpg.optimal.jpg)